For an industry that is dependent on international cooperation, what does the UK referendum (or so called Brexit) result to leave the European Union mean for the UK offshore wind industry?

In reality, it is too early to tell what the implications are for the UK as a whole until after the exit negotiation, which could take at least two years under Article 50 of the Lisbon Treaty.

That uncertainty in itself has real implications for renewable projects in the UK. Investors generally dislike uncertainty and the price demanded for increased risk is increased returns. As has been pointed out in our series of blogs on cost of energy, increases in rates of return have a disproportionate effect on cost of energy.

The referendum result has already had an immediate and dramatic impact on the value of the pound. Electricity from UK projects is sold in pounds, but much of project CAPEX is in Euros, this introduces more uncertainty. We know of investors in the UK supply chain, however, that have said that the referendum will have no impact on their decision about setting up in the UK to sell to UK projects.

Any regulatory impact will depend on the inevitably protracted negotiations. Some EU regulations restrict the number of potential development sites, but on the other hand, the industry is starting to benefit from standardisation of regulations and practices in many areas. Much progress in this area could continue with the UK still in Europe even if outside of the Union, but the rate of progress can only be expected to slow.

One of the greatest successes of the EU has been in raising environmental standards in many areas. Our legally binding EU carbon-reduction commitments may disappear, but currently the UK’s Climate Change Act has higher targets anyway. We lose the braces, but we still have the belt.

EU R&D funds have also provided a much-needed boost to offshore wind innovation, especially as UK offshore wind-specific funding has slowed. Current schemes will continue to fund projects, but longer-term UK access could reduce.

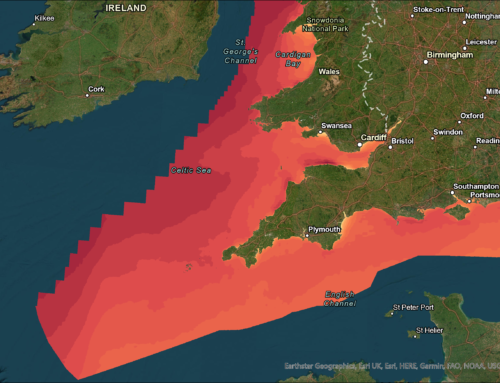

Overall, we don’t see any need for knee-jerk responses. I am confident that our industry can rise to the challenges the decision presents and maybe find some new ways to benefit. Our can-do attitude will see us through. However, if things start to unfold, we will do ourselves a favour as an industry if we continue to tell the story about how offshore wind is already making such a positive difference to businesses and communities up and down our coasts.

As the detailed implications become clearer over the coming months, I’m sure this is a topic that we’ll return to.

Managing Director

BVGA