It was great to be part of the session “’Offshore Wind – Panel: The Way Forward” at the All-Energy conference in Glasgow on 14 May. The session included a lively discussion on the recently published UK Offshore Wind Sector Deal and the Committee on Climate Change (CCC) ‘Net Zero’ report.

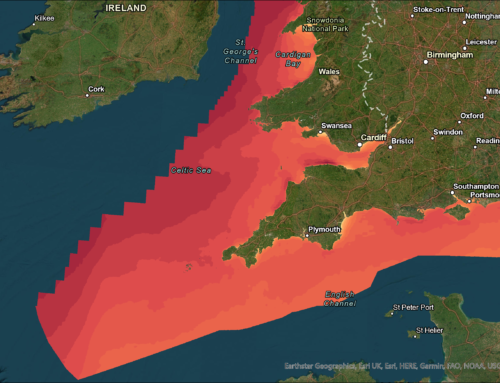

Together these show a way that the UK can get to a zero-carbon future, with 30GW of offshore wind by 2030 (the Sector Deal) and 75 GW by 2050 (CCC). We are currently engaged in work for WindEurope looking at 2050 offshore wind potential for the whole of Europe, not just the UK. Along with some of the questions at the All-Energy session, this has got me thinking about ways to accelerate offshore wind deployment.

It seems key to have a bankable way of extending this capacity. As I said at All-Energy, we could have offshore wind projects in UK waters going forward very soon expecting to take merchant risk for the revenue. But is this the best way?

When a capital-intensive project like offshore wind needs a 25-year lifetime to make a good return on the initial investment, you need to know what the energy market will be like in 25 years!

At some point soon, we will need a market that gives appropriate payments across a level playing field for available capacity (whether producing energy or not), energy supplied, energy supplied at useful times or in useful ways (demand matching, stored until required or converted to a fuel) and grid services (black-start, frequency response). This might be thought of by some as a subsidy but it already exists in other parts of our energy system. Such an approach will be required to ensure that we get the offshore wind deployment that we need to meet carbon reduction commitments.