The dust has almost settled from the latest round of UK CfD auctions. Of course, for the successful bidders the hard work has only just begun. The bid prices are below the expected wholesale electricity prices for when the projects come online. As a result, it is probable that sometimes the projects will receive effectively zero, or even negative, subsidy with the Government effectively getting an income for guaranteeing 15 years of power offtake.

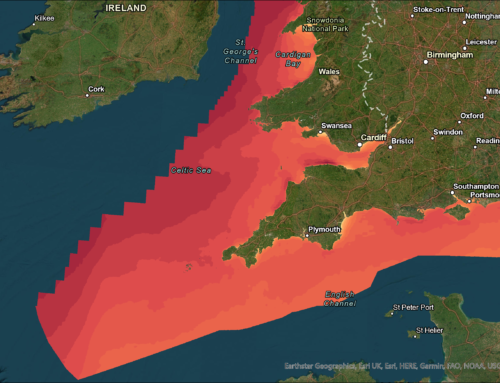

To dive deeper into how such low prices can still make commercial sense, we ran the successful bids through our geospatial LCOE models. We assumed that 12MW turbines will be used. Our analysis reveals some surprising subtleties but generally the bids do make sense. Two factors prove vital to ensuring commercial viability: turbine rating and wind farm size. It is testament to the innovation and application in the industry that only three years ago it would have not been possible to make the successful projects commercially viable. Once-ambitious assumptions about turbine size and wind farm scale are now business as usual. Investors are satisfied that the risks in these projects are well managed, reducing financing cost and hence LCOE.

In particular, the success of all the Dogger Bank projects at these low prices was surprising to many, especially given the distance from shore. A good long-distance HVDC offshore transmission link is essential for Dogger Bank. Of course, this has yet to be proven for both technology and cost, but the developers are looking to the economies of scale at this site.

These low prices mean that UK offshore wind farms are increasing likely to not need a UK CfD to proceed. This poses some extra challenges for the government in controlling extra GW without the influence of subsidies.