Overview

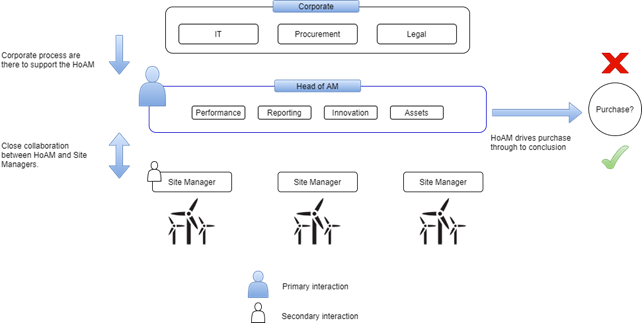

Our client originates and invests in offshore wind projects. It was looking to set up a joint venture (JV) to develop a floating offshore wind project in the Celtic Sea. It asked BVGA to carry out due diligence on potential joint venture partners.

We held workshops with the client to deliver insight on proposed partners’ offshore wind expertise, and strengths and weaknesses. We also presented on the viability of the Celtic Sea for floating offshore wind. This considered technical maturity, public sector support, supply chain and infrastructure. Finally, we summarised the commercial factors affecting Celtic Sea projects. Summaries covered non-price factors, offtake reference prices and the available funding pots within auction rounds.

Our client used our inputs to appraise the consortium and enter a JV to develop the a floating offshore wind project.

Key challenges

- Assessing the credibility, track record, and capabilities of potential partners

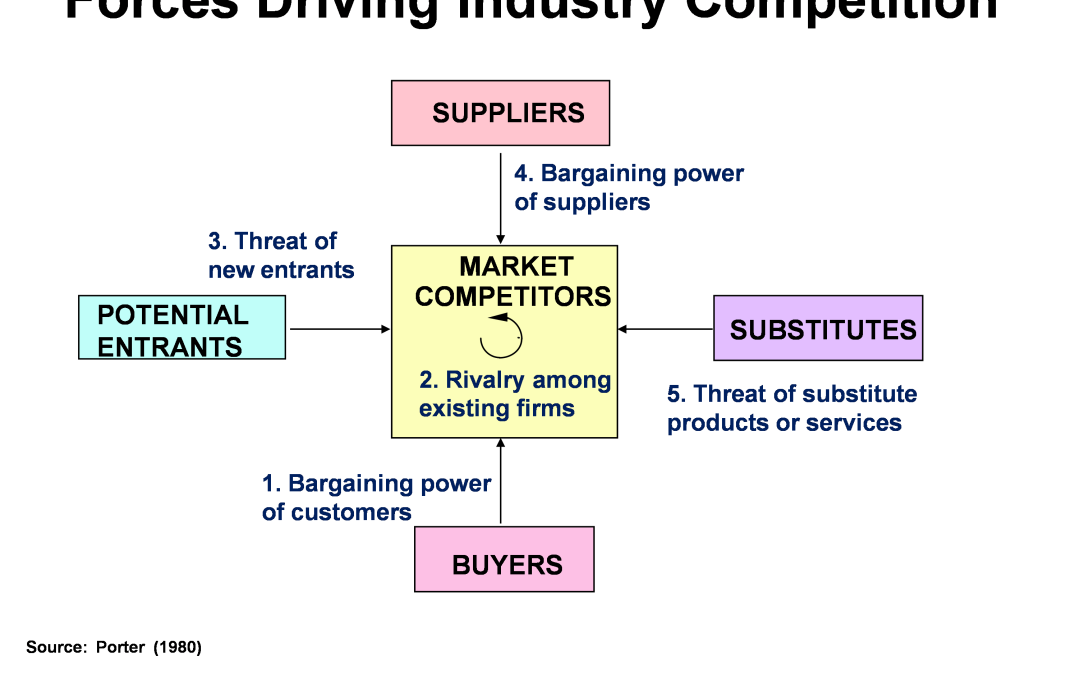

- Evaluating the technical and commercial feasibility of floating offshore wind

- Analysing the route to market

Key impact

- Delivered critical assessments of proposed joint venture partners

- Provided in-depth analysis of Celtic Sea floating offshore wind viability

- Clarified commercial considerations

- Enabled our client to make an informed investment decision

BVGA team

Matt Knight