The recently published Statement of Strategic Priorities by Great British Energy (GBE) shed more light on the role that GBE will play in our energy system over the next few years.

Here’s what we have learned:

- GBE will act as a developer and co-developer of clean energy projects. It will seek to develop a balanced and financially sustainable portfolio of projects. This includes greenfield GBE-led projects, co-development with the private sector of greenfield projects and the acquisition of stakes in more mature projects.

- GBE will support local and community energy projects, creating jobs and re-industrialisation opportunities.

- GBE will use its portfolio to support technologies with a Technology Readiness Level (TRL) of between 6 (field tested as prototype) and 9 (deployed commercially). GBE will therefore not invest in early stage research and development (R&D).

- GBE will support the development of UK clean energy supply chains, seeking to align its investments with other public sector investment. This support is expected to cover grants, loans and entering into join ventures with relevant supply chain partners.

- GBE will ensure its portfolio makes returns that make GBE self-sustaining, with a plan for this to be put in place by 2030.

GBE have also outlined the principles that will guide investments. Investment from GBE will seek to attract other forms of investment, speed up project delivery, bring larger scale clean energy projects to market, improve investor confidence, and help technologies mature. Investments will aim to increase the community benefits and social value stemming from renewable energy projects.

These are just initial principles, and in time the expectation is that GBE will in time develop a clearer set of principles as well as a framework for assessing its own performance and impact.

The statement of priorities contains plenty of noble rhetoric and its ambition and intent is to be welcomed.

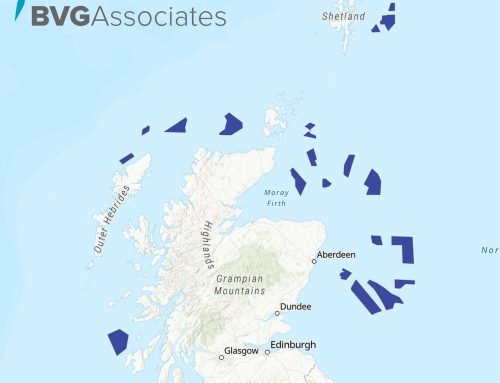

On paper, there is nothing to prevent GBE from becoming an important driver of commercial scale floating offshore wind in the UK. This could be achieved through acquiring stakes in more mature ScotWind projects or exploring opportunities linked to the unallocated 1.5 GW from this year’s LR5 leasing round.

This remit comes just four months after GBE was formally established. While that sounds like swift progress, GBE’s strategic priorities arrive 14 months into the Starmer Government that created it. Looking ahead to the next General Election, the Government will want to point to clear progress and flagship achievements. GBE’s challenge will be to demonstrate meaningful impact within this relatively short timeframe despite the long development cycles of clean energy projects.

The need for speed is not all about political optics either. If GBE delays pulling the trigger on investment, it may undermine the UK’s ability to meet energy deployment targets and capture growth opportunities.

This challenge may be exacerbated by the wide-ranging mandate it has set out. GBE will need to develop a large and skilled team capable of assessing markets and technologies across multiple market segments. Shrewd allocation of capital is important to avoid political own-goals and help GBE become financially self-sustaining. With many industries vying for GBE’s attention, robust governance and disciplined, decisive action will be essential.