After some time off for a holiday (we went to Rome, and you should too if you’ve never been) and then some illness I’m back for Part 2 of my series of blogs on “Investing in innovation” in wind. My previous one looked at the issue from a relatively high-level across a number of different areas. Here, we’ll look a little deeper at the sources of finance.

As an innovator, your challenge is to take your new, shiny, next big thing idea from its embryonic “Eureka” moment to something that will change the world and make you millions in the process. This takes time and money, both of which will likely be in short supply. I can’t magic up some time for you, so let’s focus on the money and the sources of finance.

Where the money may come from will depend a lot on your specific circumstances and your likely buyer(s). You may be inside a larger corporation and want to sell your idea to them, or you may be starting your own company with the aim of selling to the wider industry. Your idea may be people-based, software-based, hardware-based, process-based, etc. Too many possibilities to consider in detail, so we’re going to take a generic look at possible sources and then consider what is common to them all when it comes to successfully selling your idea to them. There are variety of sources of finance:

- External investment funds, specialising in:

- Venture capital – targeting start-ups and innovations

- Growth equity – targeting established offerings seeking growth

- Internal funding routes via your parent company.

Regardless of the sources of finance, the development of any new product will need its own CAPEX and OPEX plan and will need to be funded and managed separately to any other business needs. External funding sources make this happen by default, but if you are seeking funding from an internal source then this can become a very grey area indeed. From experience, I strongly urge both you and your internal client to treat it as if were an external funding source.

What we discuss now is a high-level overview of the type of market-oriented evidence and due diligence that all sources of funding should demand as part of the investment process. I highlight this because the more familiar you are with the terms and tools the better your conversations with your investors will be. They will see that you understand their challenges and that you “speak their language”.

As it happens, these market analysis tools are also commonly used in other scenarios such as:

- Leveraged buyouts

- Purchasing distressed assets, and

- Mergers and acquisitions.

There are probably many other situations worth listing, not least doing some of this yourself to confirm to your own internal team that the end prize is as indeed as compelling as you believe. Anyway, even if you are not currently developing an innovative product, perhaps what follows may be of interest anyway.

No money should be coming your way without the sources of finance understanding the market for your product. There are various aspects to evaluating a market:

- Understanding the size of the market – in terms of capacity (in wind this is often GW, but can also be measured in Projects, Turbines, etc.) and, ultimately, value (specifically the potential value of your product)

- Understanding future trends – specifically, is your product addressing a current need that will become obsolete in the future (think of a manual inspection process that will eventually be performed by remotely operated drones or vessels), and

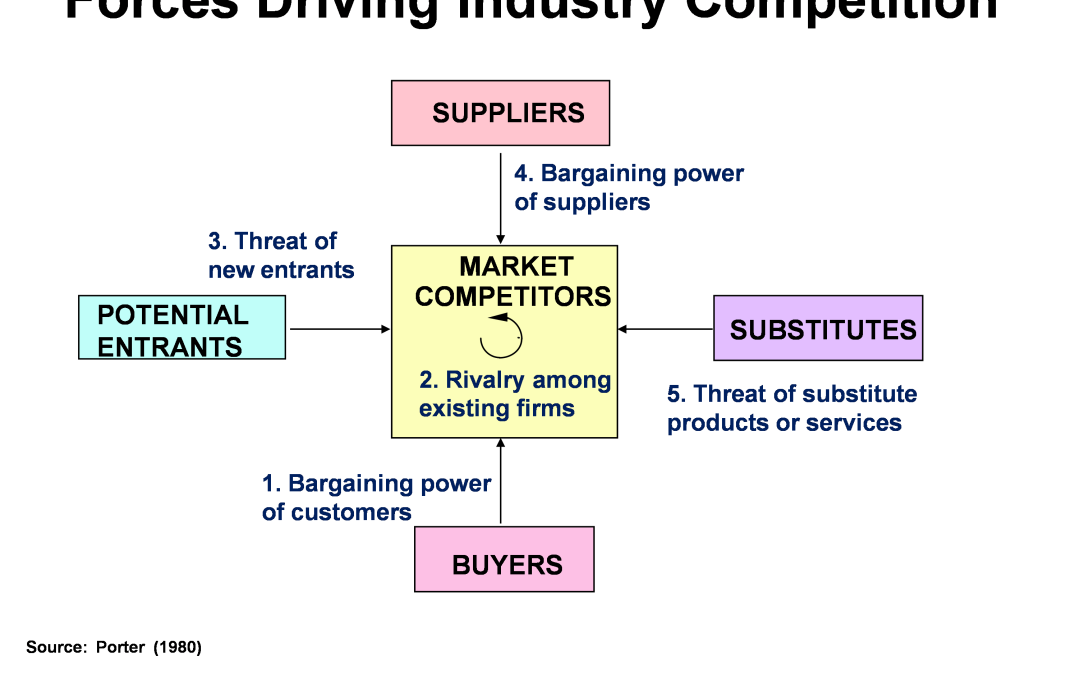

- Understanding your competitors – you’re not the only one offering this solution (are you?) so who will you be up against when fighting for market share? What is their commercial position, what are their strengths and weaknesses, etc.

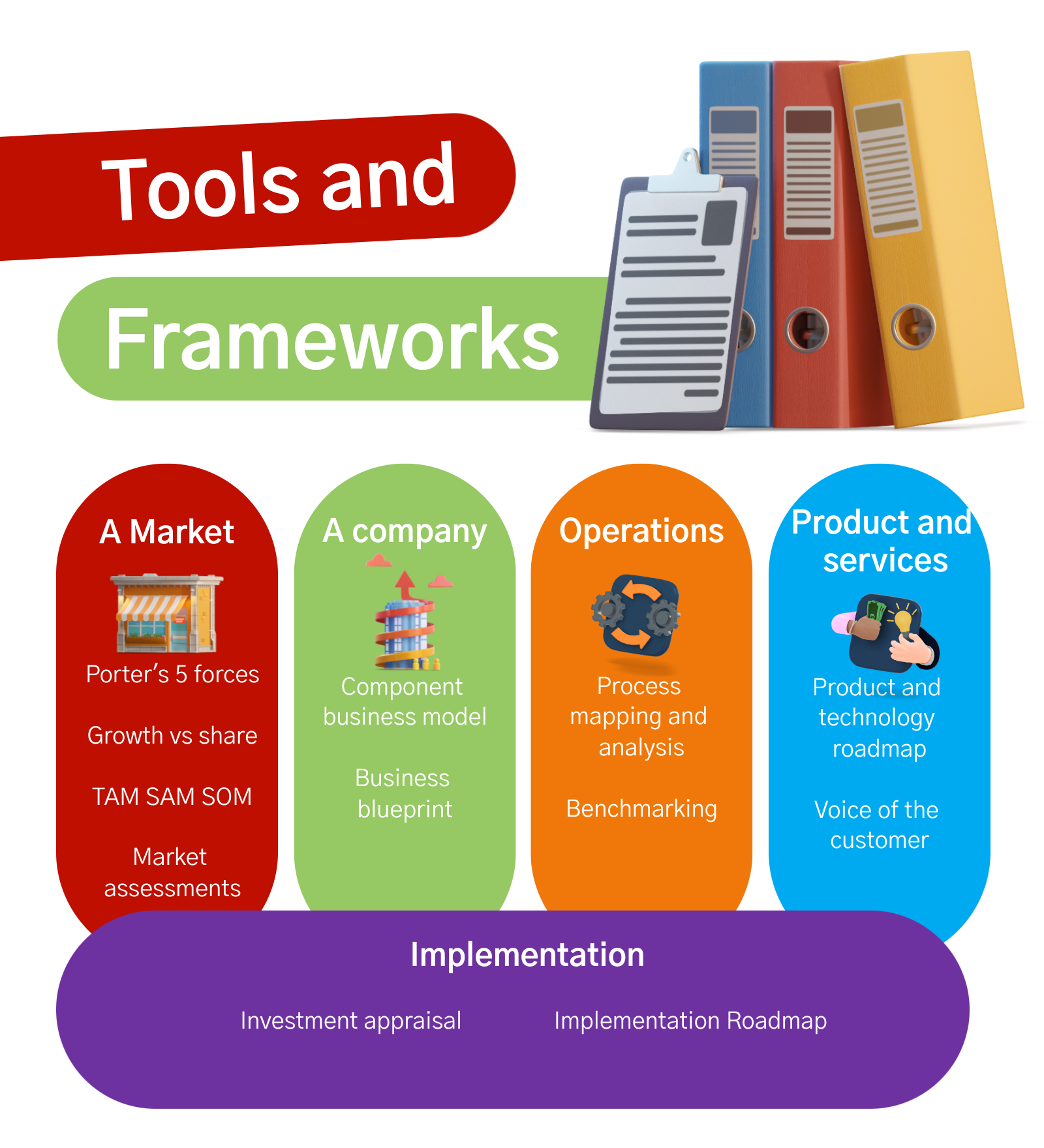

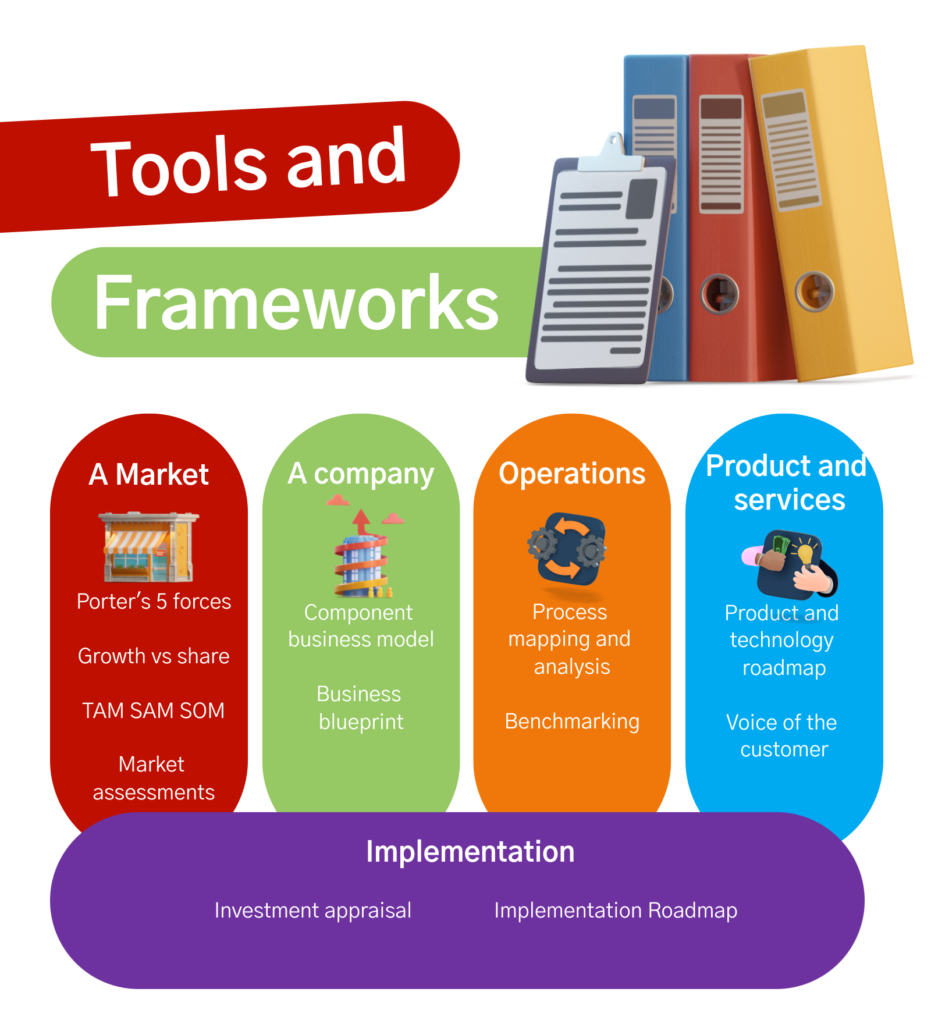

There are many tools and frameworks which help you do this type of analysis – here is a little graphic which summarises the more popular ones.

In the next blog, we’ll take a look inside a few of these using some anonymised case studies from the BVGA back catalogue.