Scottish Renewables recent investor event proved to be an excellent gathering for those with a close interest in the future of offshore wind in the UK. The sessions were both challenging – we are all (sometimes painfully) aware of the various headwinds the industry faces at this time – and encouraging, with finance still readily available to projects with a strong commercial offering, particularly when garnished with some innovation in the design of their revenue stacks.

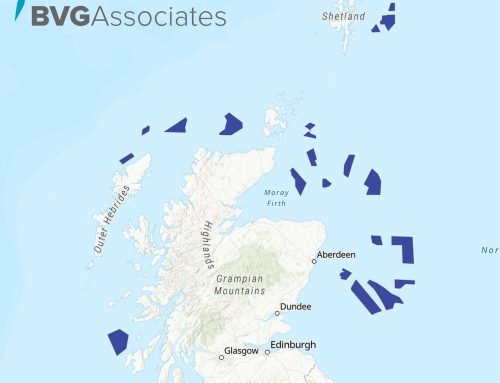

The mood was broadly positive. A recurring theme was Scotland’s perceived first-mover advantage in floating offshore wind. There was a strong sense that the eyes of the offshore wind world are on us as we forge ahead with our ambitious (and currently world leading) pipeline of 23 GW of floating projects. The sentiment was clear: the success of floating wind in the UK, and Scotland in particular, will set the tone across other western markets. We need to get it right – politically and technically. It will be a challenge, and collaboration will be key. The solution will require a global effort. The key strategic decision for us as a country is to decide which of the many pieces to this puzzle will best be provided by us – where will we add most value? It will be these pieces on which we will lead the rest of the world over the next 10 to 15 years, making the most of our position as first mover.

At a more pragmatic level, it was encouraging to hear that capital can still be readily available, though with a warning that the conditions of the playing field are shifting. A critical point of discussions was the re-pricing of project values across the market. Part of this challenge is related to the return from gilt yields which has risen by around four percentage points in the last five years, fundamentally affecting project ROI thresholds and the cost of capital. While this current phase of market adjustment is unsettling for some, most of the panellists saw it as temporary. What is more enduring is the innovation in financing models, with Inchcape’s raising of £2.7 billion via a complicated consortium of 22 different lenders being an excellent example. Diverse funding pools with a broader distribution of risk are the new normal.

From the finance side, one message in particular was clear: change is acceptable, but uncertainty is not. Finance is used to change and will adapt to new circumstances. What kills momentum is uncertainty and indecisiveness in the market. We are all waiting for clarity on key policy areas: decisions on Contracts for Difference (CfD) and Allocation Round (AR) 7, the Review of Electricity Market Arrangements (REMA), and others (zonal pricing, anyone?) have all been waiting in the wings for months if not years, with clarity expected “soon”. We finally have some movement on AR7, but the others? Continued delay in these crucial areas undermines investor confidence at a time when we need to project certainty and stability.

The forum touched on the CfD versus Corporate Power Purchase Agreement (CPPA) debate. With CfDs currently priced around £55/MWh compared with CPPAs at typically nearer £70/MWh, developers are faced with a trade-off between price certainty and term length. CfDs are currently for 15 years, while CPPAs typically 10 years or less. A policy framework must evolve to reflect this new landscape if we’re to unlock the full potential of private capital. Extending the CfD contract to 20 years or greater in AR7 would be a significantly positive move in this area, allowing CPPAs to take up space around the margins and into the merchant tail.

In summary, the Scottish Renewables investor event showed that while the financial winds may be shifting, they are far from stalling. The UK’s offshore wind sector remains one of the most compelling clean energy investment opportunities globally. But success will depend on strategic clarity, timely policy decisions, and a willingness to collaborate and innovate both in technology and finance.